Investments

About CI Investments

Meeting your retirement goals with CI Portfolio Series funds

Sophisticated, yet simple

About CI Portfolio Series funds

Portfolio Construction and Portfolio Manager Research

Monitoring Portfolio Managers and Your Retirement Investments

Background on Investment Strategy

The Board of Trustees recognized the importance of outsourcing the investment management responsibilities to a professional third party organization.

In light of the demographics of the Plan membership and the volatility of financial markets, a study was undertaken to examine the appropriateness of the asset mix and the investment risk allocation. It was concluded that the membership would be better served if a more diversified investment approach were adopted, offering members three different risk profiles (i.e. conservative, moderate and aggressive). As members approach retirement, their risk tolerance changes and assets need to be sheltered from the volatility of the financial markets. A fourth option, the Money Market Fund, was later added. Members have the opportunity to change portfolio twice per year, July 1 and January 1.

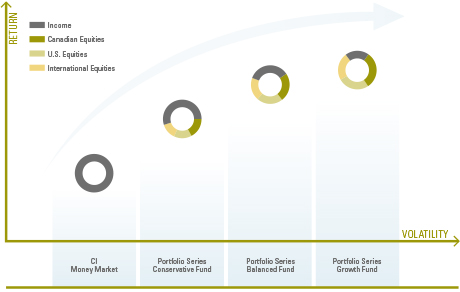

CI Investments offers four asset allocation funds (CI Money Market Fund, Portfolio Series Conservative Fund, Portfolio Series Balanced Fund and Portfolio Series Growth Fund).

About CI Investments

CI Multi-Asset Management, a division of CI Investments, focuses on a manager-of-managers asset allocation investment strategy, appointing multiple specialist portfolio managers. Through their extensive investment management research, CI Investments has created four mutual funds featuring Managers hired to run specific investment mandates. CI Investments embraces the philosophy of active management and applies it to all aspects of its investment process. The team believes that security quality and valuation drive investment performance over the long term. Valuation is not limited to the relative valuation of just stocks. It also includes valuation of asset classes and currencies. Highly skilled portfolio managers can capitalize on attractive valuations to add alpha. CI Investments favours managers who excel at security selection and are not afraid to differentiate their portfolios from an arbitrary benchmark index.

For more information, visit www.ci.com.

Meeting your retirement goals with CI Portfolio Series funds

CI Investments understands the issues faced by group retirement plan members like yourself. Their goal is to help you achieve your retirement objectives and give you and your family the kind of future you deserve.

CI provides an array of portfolio options that make investing easy for you. The Portfolio Series is a family of four strategic asset allocation funds that provide diversified portfolios meeting a range of distinct investor profiles, from capital preservation to growth. The portfolios achieve their objectives by investing in an array of funds managed by different underlying portfolio management teams, providing diversification by asset class, investment style, region and economic sector.

The Portfolio Series funds follow a disciplined investment management methodology which includes consideration of asset allocation, portfolio structure, multiple specialist managers and overall portfolio management. This results in an investment program that makes sense in any financial climate.

Sophisticated, yet simple

The Portfolio Series funds have been designed to take into account different financial situations, retirement goals, tolerance for risk and levels of investment knowledge. Regardless of what your investment objectives are, the Portfolio Series funds will meet your needs.

Once you have selected a fund that matches your financial situation, you need only revisit your selection on a semi-annual basis or when a major life event occurs, such as marriage, buying a house, or having children. Altering your investment choice is only necessary when your investment objectives or tolerance for risk changes.

The funds deliver a sophisticated multi-manager, multi-style, multi-asset class structure without the confusion and complexity associated with creating one. The Portfolio Series is a sophisticated product that makes investing simple for you.

About Portfolio Series funds

The portfolios in the Portfolio Series have been carefully crafted by CI Multi-Asset Management based on research and recommendations from State Street Global Advisors - a world leader in asset allocation. This research goes beyond historical returns to embrace a forward-looking framework.

Portfolio Series offers the expertise of portfolio managers with proven track records, including Signature Global Asset Management , Cambridge Global Asset Management and Harbour Advisors. These managers, through the underlying funds, have the discretion and opportunities to add value using day-to-day tactical actions through stock selection and sector allocation.

This significant investment expertise is available to you with the simplicity and convenience of a single fund to purchase and track.

Portfolio Construction and Portfolio Manager Research

CI Multi-Asset Management is responsible for the construction and management of CI Investments' managed solutions programs. Based in Toronto, the team oversees more than $40 billion of assets invested in customized managed portfolio solutions for individuals, families and businesses.

CI Multi-Asset Management embraces the philosophy of active management and applies it to all aspects of its investment process. The term active management stretches beyond the practice of stock selection. The team views active management as a process that strives to identify and manage all the variables and factors that can influence an investor's total return.

Asset allocation must be applied intelligently to ensure that a portfolio generates sufficient returns for the level of risk it is taking. CI Multi-Asset Management believes it is critical to have a clear understanding of valuations, fundamentals and correlations in order to construct and manage efficient portfolios. A portfolio that combines asset classes exhibiting negative or weak correlations with each other has greater opportunities for improving risk-adjusted returns. Using a multi-asset-class framework offers the best opportunities to benefit from imperfect correlations.

Monitoring Portfolio Managers and Your Retirement Investments

You need not worry about replacing portfolio managers if their performance isn't meeting your objectives. You also need not worry about your asset mix moving away from your target. (Your asset mix is the mix between stocks and bonds.)

CI believes this high level of attention is the only way to provide the risk control you require to ensure that your retirement savings stay on track and meet your objectives.

|